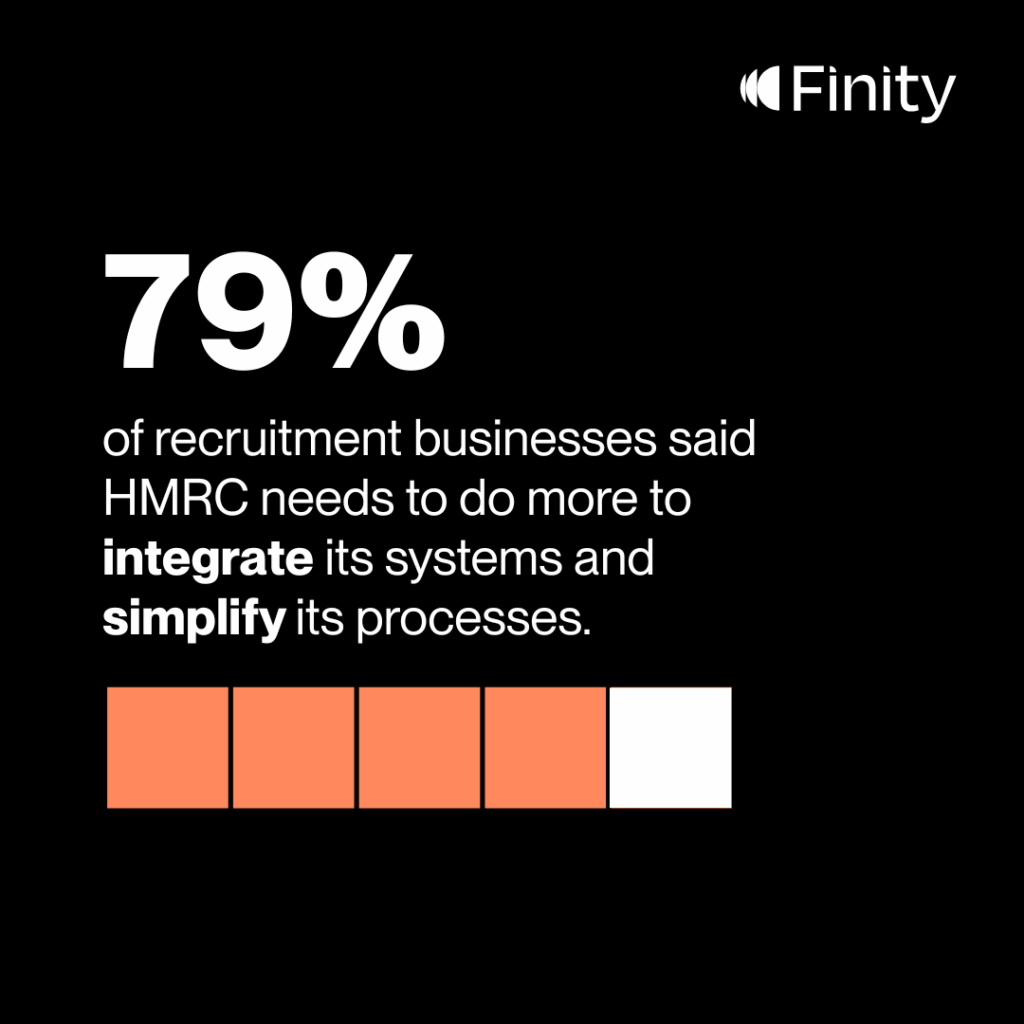

- Overall sentiment towards the new legislation was focused on integration and simplification, with almost 80% saying HMRC needs to do more to integrate its systems and simplify its processes

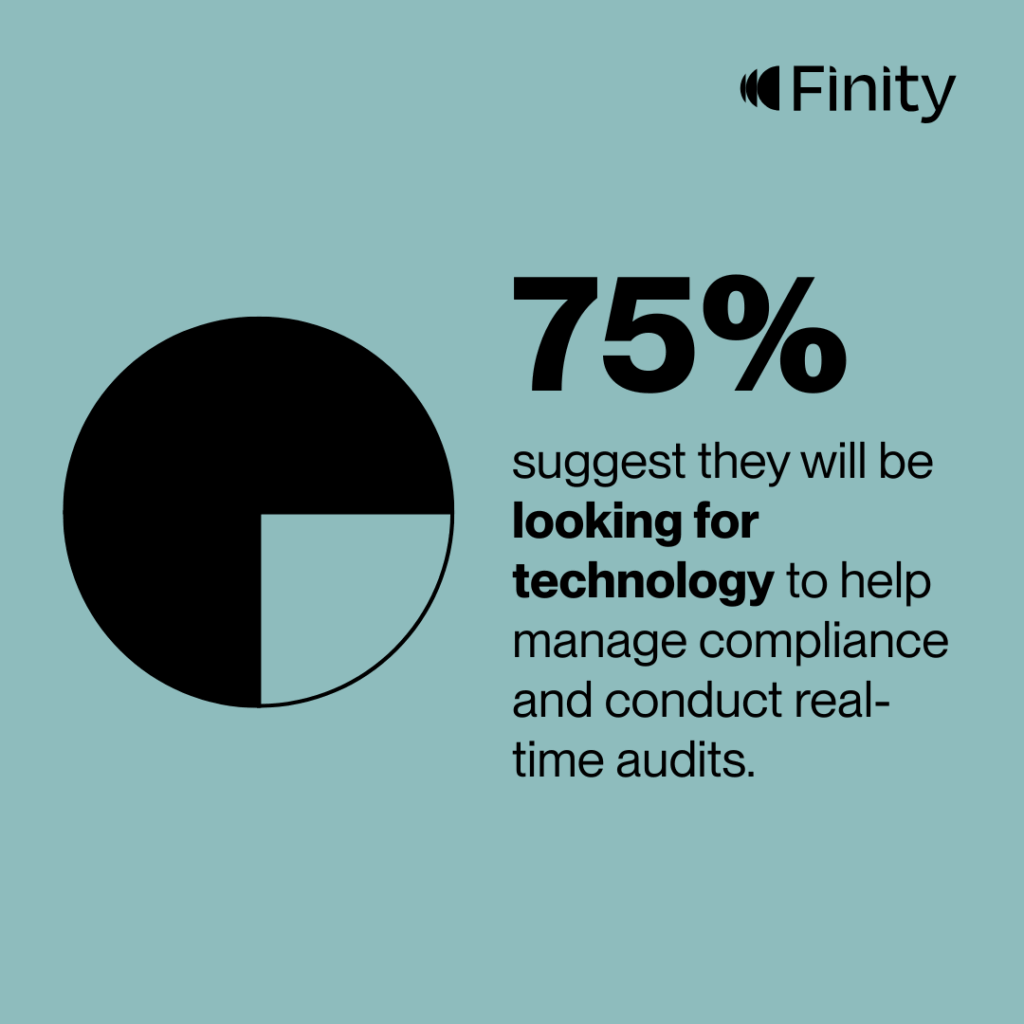

- 75% suggest they will be looking for technology to help manage compliance and conduct real-time audits.

As HMRC announces its decision to introduce Joint and Several Liability in April 2026, new research from Finity has found that almost 80% of recruitment agencies want the tax authority to do more to integrate its systems and simplify processes.

Commissioned by recruitment back office platform, Finity, the survey of employees within finance departments in temporary recruitment agencies explored sentiment towards the landmark ‘Tackling Non-Compliance in the Umbrella Company Market’ legislation, set to take effect from 6 April, 2026.

Integration, simplification and technology is key

An overwhelming four-fifths (79%) of respondents state that HMRC needs to do more to integrate its systems and simplify processes. This was followed by the need for technologies to support adherence to these new legal obligations, with three-quarters (75%) suggesting they will be looking for technology to help manage compliance and conduct real-time audits.

Varun Monteiro, CEO at Finity, said: “The latest update from HMRC marks a welcome, but significant change for umbrella companies and agencies, with accountability pushed further up the supply chain and significant financial repercussions for errors.

“However, our data shows a clear call from recruitment businesses for urgent action from HMRC and the broader industry when it comes to systems, processes and enabling technologies.

“Our research, combined with our detailed whitepaper, presents a bold call to action for HMRC to provide the digital infrastructure required to tackle compliance at source. While HMRC’s accompanying Transformation Roadmap is a positive step forward, it is clear better integration and the ability to cross-check payslips with HMRC data through simple APIs, directly within payroll systems, is vital.

“Only by making essential tax information more accessible and instant, can the recruitment sector be truly empowered to verify their tax liabilities efficiently and with confidence.”

The need for a modernised and transparent tax system, powered by technology

Dale Simkiss, compliance expert and Non-Executive Director at Finity, added: “Currently, businesses in the recruitment sector face significant challenges in verifying whether tax liabilities have been accurately reported and settled in their supply chain.

“As the industry prepares for a new legislative landscape, now is the time to modernise the way we manage tax compliance, which will help ease the burden on the sector, mitigate financial risks and create a more transparent and trustworthy tax system.”

Varun Monteiro, concluded: “This will be made even more challenging with HMRC’s new regulations which seek to enforce stronger measures for tax transparency and accountability.

“As our research has indicated, there is strong desire for new technology, not least because of the lack of efficient, real-time access to tax data, which is likely to hamper efforts to comply, leaving businesses vulnerable to compliance failures, fraud or reputational damage.”

To view the full report, which outlines the roadmap Finity is proposing to help HMRC and the wider market deliver a modern and compliant tax system, please visit www.finity.co.uk/tax-compliance-whitepaper/.

Recent Comments